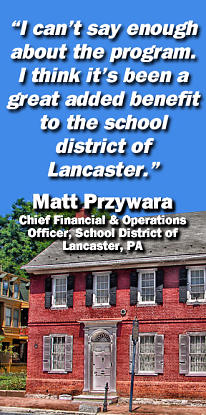

Matt Przywara, Chief

Financial & Operations

Officer, School District

of Lancaster, PA, is

one of many satisfied

MRS clients (click on

the references tab at

the top of this page to

see them all). Watch

this short video where

Matt explains, and

endorses, the MRS

Tax Lien Management

Program.

Helping PA Taxing Districts Generate New

Revenue for Their Budgets Since 2004

MRS turns underperforming assets into new cash as part of its Best Practices approach to tax

lien management. In the business world you would not tolerate receivables older than 90

days, then why put up with 90+ day old receivables on your books now? A well run business

knows how much revenue they will receive when they send out bills. Does your taxing

district? Unless you’re using the MRS Program, you can only guess, so why not convert your

dormant assets into instant revenue today instead of waiting up to four years to access them.

MRS assures that your annual delinquent real-estate tax revenue will be predictable. Our

program maximizes your delinquent real-estate receivables, often providing a return near or

in excess of your actual annual collections’ turnovers. The cost of the program is paid by our

non-profit borrower, not the taxpayer or the district. In 2011 PASBO, an authority on school

business practices, recommended that districts take advantage of tax lien sales as a routine

revenue enhancement strategy.

Over the years MRS

has traveled across

Pennsylvania visiting

clients and shooting

video interviews. Here

are a handful of

testimonials from

satisfied business

managers from taxing

districts that have

used the MRS

Program. Their

comments support

our Best Practices

approach.

CONTACT US

Phone: 814-476-0400

P.O. Box 9606

Erie, PA 16505-8606

LINKS

POWERPOINT

SOCIAL MEDIA

©2023 Municipal Revenue Service. Municipal Revenue Service is a Patented Tax Lien Management Program. All Rights Reserved.

MRS turns underperforming assets into new cash as

part of its Best Practices approach to tax lien

management. In the business world you would not

tolerate receivables older than 90 days, then why put

up with 90+ day old receivables on your books now?

A well run business knows how much revenue they

will receive when they send out bills. Does your

taxing district? Unless you’re using the MRS Program,

you can only guess, so why not convert your

dormant assets into instant revenue today instead of

waiting up to four years to access them. MRS assures

that your annual delinquent real-estate tax revenue

will be predictable. Our program maximizes your

delinquent real-estate receivables, often providing a

return near or in excess of your actual annual

collections’ turnovers. The cost of the program is

paid by our non-profit borrower, not the taxpayer or

the district. In 2011 PASBO, an authority on school

business practices, recommended that districts take

advantage of tax lien sales as a routine revenue

enhancement strategy.

CONTACT US

Phone: 814-476-0400

P.O. Box 9606

Erie, PA 16505-8606

©2023 Municipal Revenue Service.

Matt Przywara, Chief Financial & Operations Officer,

School District of Lancaster, PA, is one of many

satisfied MRS clients (click on the references tab at

the top of this page to see them all). Watch this short

video where Matt explains, and endorses, the MRS

Tax Lien Management Program.

Over the years MRS has traveled across Pennsylvania

visiting clients and shooting video interviews. Here

are a handful of testimonials from satisfied business

managers from taxing districts that have used the

MRS Program. Their comments support our Best

Practices approach.